Etsy Stock Looks To Expand Its Buyers, But Faces Headwinds |

您所在的位置:网站首页 › gmv gms › Etsy Stock Looks To Expand Its Buyers, But Faces Headwinds |

Etsy Stock Looks To Expand Its Buyers, But Faces Headwinds

|

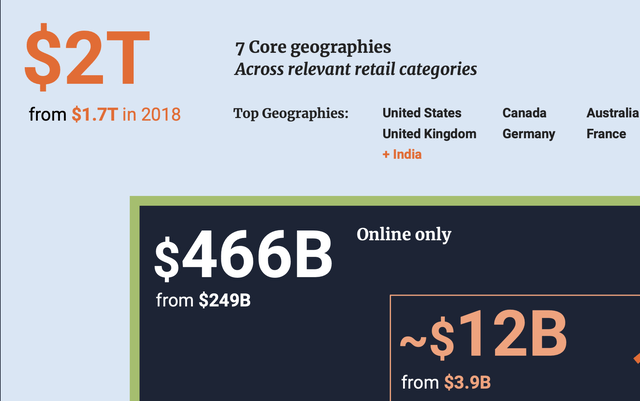

olindana/iStock via Getty Images Etsy (NASDAQ:ETSY) has some nice growth opportunities ahead of it, but economic softness and vendors selling unlicensed merchandise pose risks. Company ProfileETSY is an operator of two-sided marketplaces that connects buyers and sellers. Its main marketplace is Etsy.com, where buyers sell crafts, handmade goods, vintage items, and other unique items. About 26% of the goods sold on its marketplace in 2022 were custom or made-to-order merchandise. In addition to its namesake marketplace, the company also runs Reverb, a musical instrument marketplace; fashion resale marketplace Depop; and Elo7, a Brazilian -based marketplace for handmade and unique goods. Etsy is its largest contributor, with GMS (gross merchandise sales) of $12 billion in 2022. Reverb had GMS of $943 million, Depop's GMS was $552 million, and Elo7 produced GMS of $70 million. The company generates revenue from both required fees, which it calls Marketplace Revenue, as well as through value-added services, which it calls Services Revenue. Marketplace revenue consists of listing fees, transaction fees, payment processing fees, and offside ad transactions fees. Services Revenue, meanwhile, comes from shipping labels, on-site advertising, and other services. In 2022, Marketplace revenue represented nearly 75% of the total, while Services was over 25%. Opportunities and RisksOne of the biggest opportunities for ETSY moving forward is increasing its number of buyers. Broadening its appeal to men and expanding its geographic reach are two ways the company is looking to do this. At the end of 2022, the company had 89.4 million active buyers, of which 22 million were men, or just under 25%. At the same time, the company has said only 10% of men in the U.S. had shopped its platform over the past year. While that number is small, active men buyers are up 124% since 2019 as the company looks to target this demographic more. CEO Joshua Silverman talked about attracting male buyers at a December UBS conference, saying: "When we talk about new buyer, by the way, we mean truly new to Etsy. If you shop at Etsy a decade ago, and you come back and shop on Etsy again today, we don't count you as new. We count you as reactivated. So these are truly new to Etsy as far as we know. And we're seeing that the cohorts look quite similar to pre-pandemic. They are slightly more male, and they're slightly less active. So we are penetrating deeper segments of the population than we were before. But Etsy was never particularly [helpful]. So these are changes on the margins, not massive changes. We have had a very strong female skew, and we're realizing now that some of that is probably a self-perpetuating cycle. "Like inside of Etsy, we exclusively use the female pronoun when I'm talking about our customers, buyers and sellers, because historically, they've been over like 85% to 90% women, both sides. So we just haven't thought about male buyers. And we started looking at the data and say, well, we do have millions of male buyers, and we have great purchase occasions for them. So now you're starting to see us market in the NFL, and we're seeing that work." International expansion is another big opportunity for ETSY. About 55% of its GMV comes from the U.S., but it is only really in 7 core markets. The company has really been leaning into the German market the last couple of years, using it as a test ground for other markets. It went heavy on TV advertising earlier than it normally would back in 2021, which really helped drive results in 2022. It also has recently entered India, starting to lay the foundation there with investments in things like local payment options.

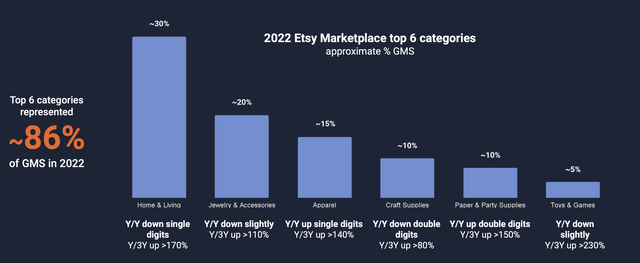

ETSY Geographies (Company Presentation) At a Nasdaq Conference in December, CFO Rachel Glaser said: "Geographically, on the new buyers, attracting new buyers to come in, we've seen more significant growth internationally. And that seems reasonable to us because we've only been able to, in the past year or 2, get to what we call 2-sided equilibrium in both the U.K. and Germany. That means there's as much buyer demand as there is supply... And so we've seen that growth in the U.K. and Germany. We've been able to turn on brand marketing campaigns in each of those markets... And that brand marketing campaign is the thing that not only introduces new buyers to what Etsy is, like what are we, but also it's the tap on the shoulder to remind people, oh, yes, remember that Halloween costume you bought for your dog last year, come back because you can also buy all this stuff for holiday. "And it's really in those European markets that are relatively new to the Etsy story, it seems like it's a brand-new exciting thing for them to find. So it's reasonable to us that a lot of the new buyers are coming to us internationally. We see a lot of opportunity for continued growth in those markets not yet penetrated. In fact, the U.S., we feel, is a relatively immature market. And we have our sights on other key European markets. And we've started to lay down some foundational track in India to sort of invest in that as both an export market and a domestic 2-sided marketplace." The company is also working to bring back lapsed buyers who have previously used the site, as well as attract more sellers. More buyers can attract more sellers, and over 50% of Etsy sellers use multiple channels to sell their wares. ETSY has also looked to boost revenue by increasing fees and raised the seller transaction fee on its namesake site from 5% to 6.5% last year. However, this led many ETSY users to become upset, causing over 20,000 sellers to protest by putting their online shops in "vacation mode." Silverman, however, has repeatedly said that the company has seen no seller churn as a result of the fee hike. Buyers and sellers have also become frustrated in the past with Chinese sellers selling items on Etsy claiming to be handmade that are mass-produced or counterfeit. Citron Research recently pointed this out in a negative report about the company, although it's been a complaint for many years. Like other e-commerce companies, ETSY faces risks from a slowing economy. The company's #1 category is actually home furnishings, which tends to be pretty economically sensitive. ETSY sellers also got a boost during the pandemic, which waned last year, as evidenced by its -4% decline in GMS in Q4 and -1.3% for 2022.

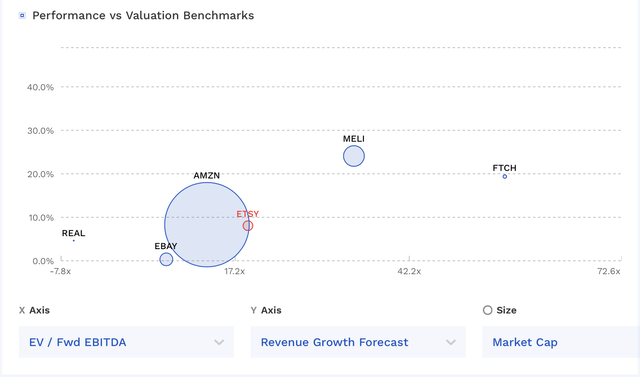

Company Presentation The company also began to see trends starting to weaken in late January. At a Canaccord Conference in March, Glaser said: "In 2023, we started off really strong in January and then started to see volatility in late Jan, early Feb. So by the time we were getting on our call in Feb, we talked about that volatility a lot. And we were observing, through a lot of third-party data, credit card data and other things, that as many people saw, there was some spending shift from consumer goods to things other kinds of consumer discretionary, like services; and household essentials, like milk. And we were observing that. But when we double-clicked on our own categories, the big categories that we are in, we saw that, for instance, home and living or apparel and accessories, that we were actually holding up quite well within those categories. So we felt confident that we were maintaining or growing share in our categories, but volatility relative to shifts in consumer spending overall. The guidance we gave assumed that, that volatility at the midpoint would be maintained through the end of March. And if that volatility were to cease, we would see some upside at the high end. If it were to get worse, we would see some downside at the low end." ValuationETSY currently trades around 19.5x the 2023 consensus EBITDA of $769.1 million and about 17x the FY2024 consensus of $887.2 million. It trades at a forward PE of nearly 28.2x the 2023 consensus of $3.92 and just over 23.5x the 2024 consensus of $4.69. Revenue growth is expected to be 8% this year, and then grow around 12-17% a year over the next few years. ETSY trades at the higher end of multiples for more mature established marketplaces, but less than higher growth emerging ones.

ETSY Valuation Vs Peers (FinBox) ConclusionETSY certainly has a number of opportunities ahead of it with international expansion, bringing more male buyers to the platform, re-activating lapsed users, and raising fees. In the near term, however, this will be counteracted by a weakening consumer that is more interested in experiences coming out of the pandemic. Its vendors are also selling in categories that are often cut in a recession, such as home furnishings, jewelry, and apparel. The fact that ETSY allows fake handmade goods and non-licensed items on its website isn't a new revelation, and I don't think the company is going to run and better police these activities unless pressed to do so. The more attention it gets, though, the more risk there is that the company gets sued by a brand to stop it, which could both add legal fees and potentially take out a chunk of its sales. At this point, I see a bit more risk to the downside, but overall I'm largely neutral on the stock at these prices. |

【本文地址】